Partenaire technologique des assureurs Pro et Entreprise

Une connaissance approfondie des risques grâce à l’open data et à l’IA, pour une couverture complète du processus de souscription. Basculez dans l’ère de la souscription augmentée avec Continuity.

700

utilisateurs

6000

distributeurs

1 million

de contrats

5 milliards

de primes

Simplification de la souscription

Accédez à une vue complète du risque

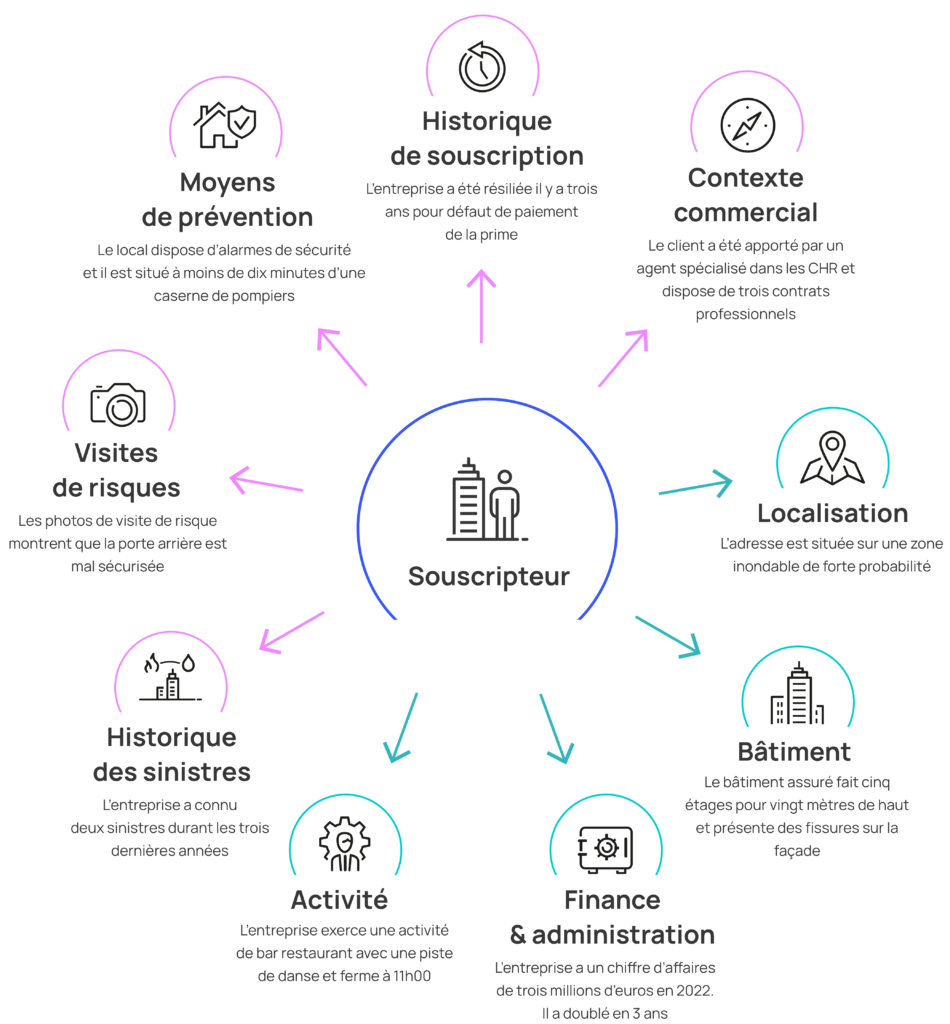

Continuity simplifie le processus de souscription en centralisant l’ensemble des données nécessaires à une évaluation précise et accélérée des risques.

Notre plateforme s’attaque à deux défis majeurs :

- Assurer un meilleur suivi des clients en portefeuille tout au long de la vie de leur contrat

- Accélérer la souscription d’affaires nouvelles, tout en la fidélisant

Notre plateforme transforme le labyrinthe des données assurantielles en une interface unique, claire et intuitive, libérant les souscripteurs des tâches complexes pour se focaliser sur l’essentiel : renforcer la relation client et la qualité du service.

Des solutions éprouvées,

des bénéfices tangibles

Nos solutions vous garantissent un gain d’efficacité notable, une amélioration de la productivité et une meilleure satisfaction client.

Satisfaction

Maximisez la fidélité de vos clients avec un suivi proactif et personnalisé qui va au-delà des attentes.

Conformité

Renforcez votre devoir de conseil et la conformité de vos pratiques de souscription pour maintenir une image de marque impeccable.

Croissance

Accélérez la prise de décisions et la souscription pour stimuler la croissance et améliorer le taux de conversion.

Rentabilité

Ajustez les primes d’assurance pour qu’elles reflètent fidèlement la réalité des risques, optimisant ainsi la rentabilité de chaque contrat.

Pourquoi choisir Continuity ?

Un partenaire technologique 100% dédié au marché du IARD professionnel et entreprise.

La plus grande

équipe tech du marché

Une équipe d’experts en Data, IA et IARD tous azimuts

Depuis notre création en 2019, Continuity s’est imposée comme un leader technologique, soutenue par un financement de 15M€ et une équipe diversifiée, unissant la tech, l’IA et l’expertise en assurance pour répondre à vos besoins de croissance et de qualité de service.

Ce que nos partenaires disent de nous

Ils nous font confiance

Collaboration, innovation, co-construction :

ensemble, nous redéfinissons l’assurance de demain.

Actus & insights

Partenariats, Innovations Produits et Avancées Technologiques.

- Continuity à la Semana del Seguro 2026 : anticiper les risques cachés pour une souscription plus performanteLa Semana del Seguro 2026 s’impose comme l’un des rendez-vous majeurs du secteur de l’assurance en Espagne. Dans ce cadre, Continuity participera activement à l’événement en animant une session dédiée à … Continuity à la Semana del Seguro 2026 : anticiper les risques cachés pour une souscription plus performante

- Sécurité certifiée : Continuity obtient la norme ISO/IEC 27001Continuity a obtenu la certification ISO/IEC 27001, délivrée par l’organisme indépendant ACCORP. Cette certification constitue le principal référentiel international en matière de gestion de la sécurité de l’information. Elle atteste que … Sécurité certifiée : Continuity obtient la norme ISO/IEC 27001

- Interview – Benoît Pastorelli, CEO de Continuity : “Notre ambition internationale devient concrète”Dans une interview accordée à News Assurances Pro à l’occasion INNN 2025, à Niort, Benoît Pastorelli, CEO de Continuity, revient sur les grandes étapes de l’année écoulée : l’accélération du développement … Interview – Benoît Pastorelli, CEO de Continuity : “Notre ambition internationale devient concrète”