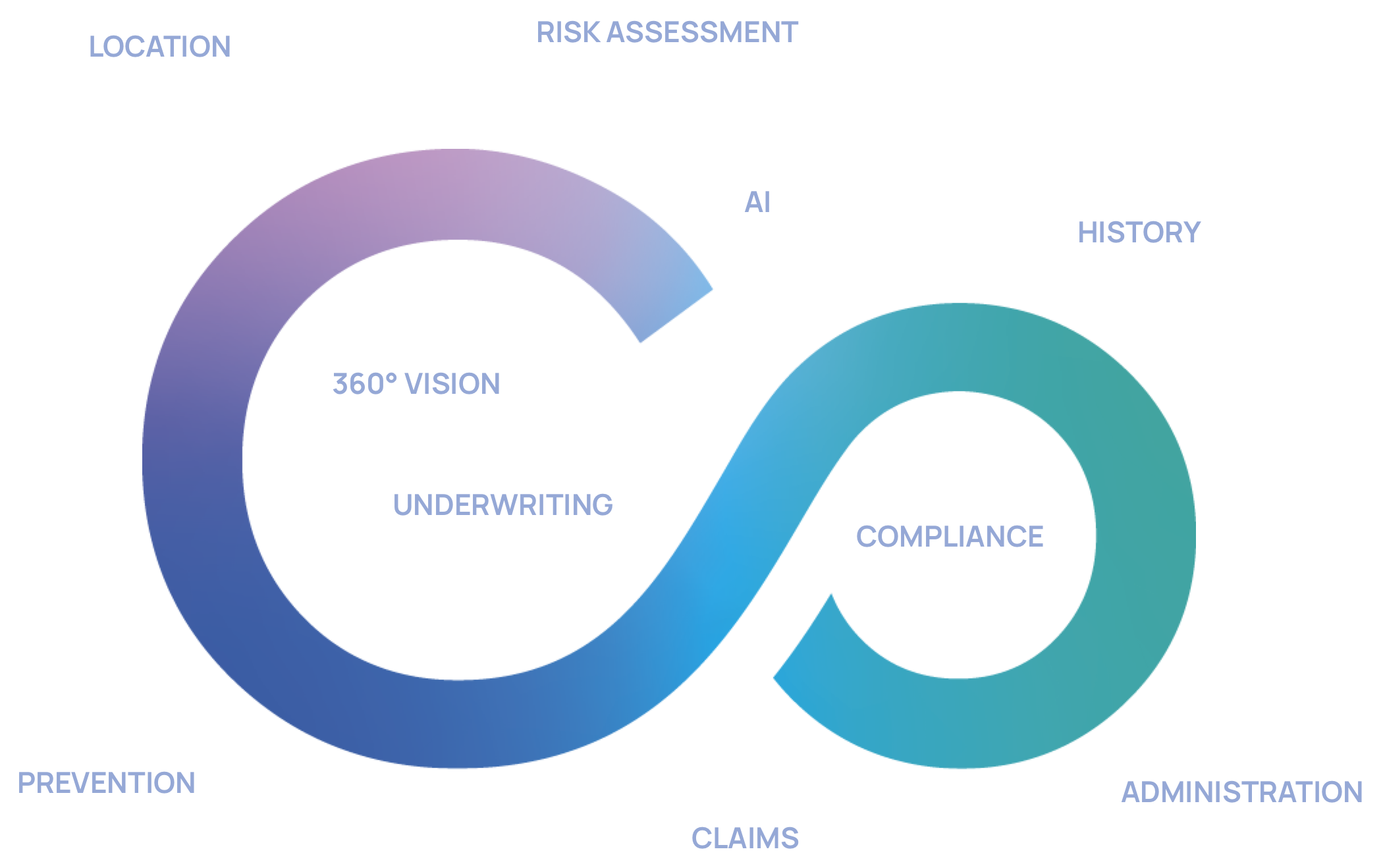

AI-powered risk detection for P&C commercial lines

Continuity empowers commercial insurers to streamline underwriting from portfolio entry throughout the lifecycle, providing immediately actionable insights to enhance profitability and save valuable time.

700

users

6000

distributors

1 million

policies analyzed

2 billion

in premiums managed

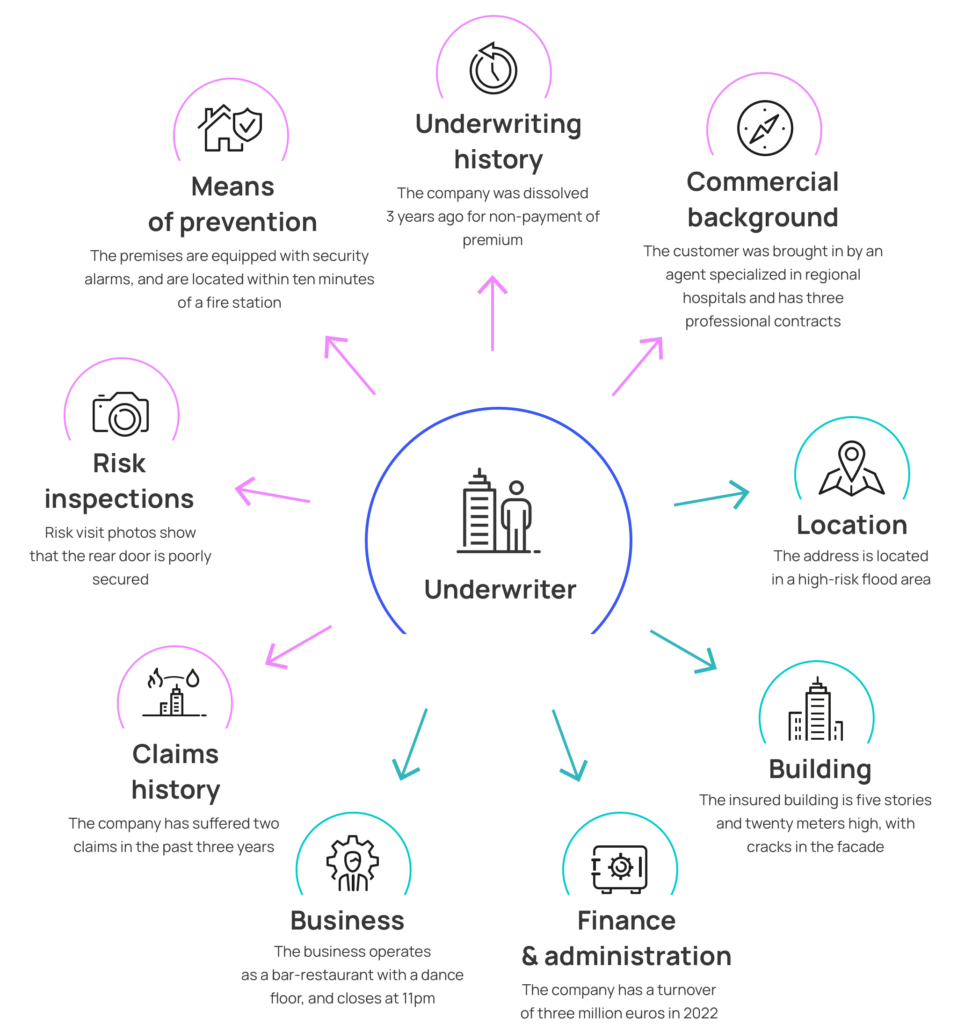

Simplified underwriting

Complete and faster assessment of risk

Continuity streamlines the underwriting process by consolidating all necessary data for swift and precise risk assessment.

Our platform addresses two primary issues:

- Providing enhanced monitoring of customer portfolios for the duration of their policies

- Speeding up the underwriting process when analyzing new policies, and fostering customer loyalty

By transforming the maze of insurance data into a unified, clear, and intuitive interface, our platform liberates underwriters from complex tasks. This allows them to concentrate on what truly matters: bolstering customer relations and service quality.

Proven solutions, tangible benefits

Our solutions guarantee significant efficiency gains, improved productivity and enhanced customer satisfaction.

Satisfaction

Boost customer loyalty by exceeding expectations with proactive, personalized follow-up.

Compliance

Improve your advisory skills and adhere to underwriting practices to uphold a flawless brand image.

Growth

Speed up decision-making and underwriting processes to stimulate growth and enhance conversion rates.

Profitability

Align insurance premiums with actual risk levels to optimize the profitability of each policy.

Why choose Continuity ?

A 100% dedicated technology partner for the professional and business Property and Casualty (P&C) insurance market.

Largest Tech

Team in the market

A team of experts in Data, AI, and P&C

Since 2019, Continuity became an established technological leader. With €15 million in funding and a diverse team, we unite tech, AI, and insurance expertise to cater to your growth and service quality needs.

What Our Partners Say About Us

They trust us

Collaboration, Innovation, Co-construction:

Together, we are redefining the insurance of tomorrow.