DATA-CENTRIC AI

AI for Property and Casualty Insurance

In a data-saturated world, the real challenge is extracting meaningful insights and interpreting them accurately for insurance. Continuity empowers Pro & Business insurers with precise risk analysis and underwriting recommendations, leveraging a powerful data platform and specialized AI models.

75%

R&D

profiles

57M

buildings analyzed

15

models in production

100

impactful analyses

Insurance Centric AI

Specialized AI for Property and Casualty Insurance Risk

Continuity develops specialized AI for risk analysis in underwriting, offering software tailored for P&C insurance companies. Our tech infrastructure focuses on data transformation, exploitation, and enhancement.

We harness AI and data (external, proprietary, and purchased) to convert complex information into actionable insights. Our commitment to solid governance, impeccable data quality, and the largest R&D team dedicated to Pro/TPE/SME P&C risks sets us apart.

By early 2024, with over 100 analyses, 35 risk alerts, and the capability to display 27M building shapes, Continuity excels in data richness and precision. Our proprietary database, 15 ML models in production, and rapid case analysis distinguish us.

Using advanced architectures like Transformers, Continuity ensures high-quality, data-rich models, delivering precise, actionable insights for Pro and Business insurers.

Technological Leadership

Proprietary AI Models

Proprietary AI models enhance reliability and strengthen data assets.

Over 15 specialized AI models for insurance-specific data analysis.

Tens of thousands of high-value annotations for precise AI models and enriched datasets.

50 million training data points in insurance refine our AI algorithms.

Scalable Data Platform

External Data Collection from Various Sources

Aggregation of external data from open sources, insurers, and third parties into a scalable platform.

Over 30 external data pipelines, with significant AI efforts making these datasets usable.

Over 300 data points per company, offering unprecedented detail.

Over 300 million data rows for exhaustive analysis.

Underwriting-Focused SaaS

Access via a SaaS (Software as a Service) platform focused on underwriting, making tools and information easily accessible to insurers.

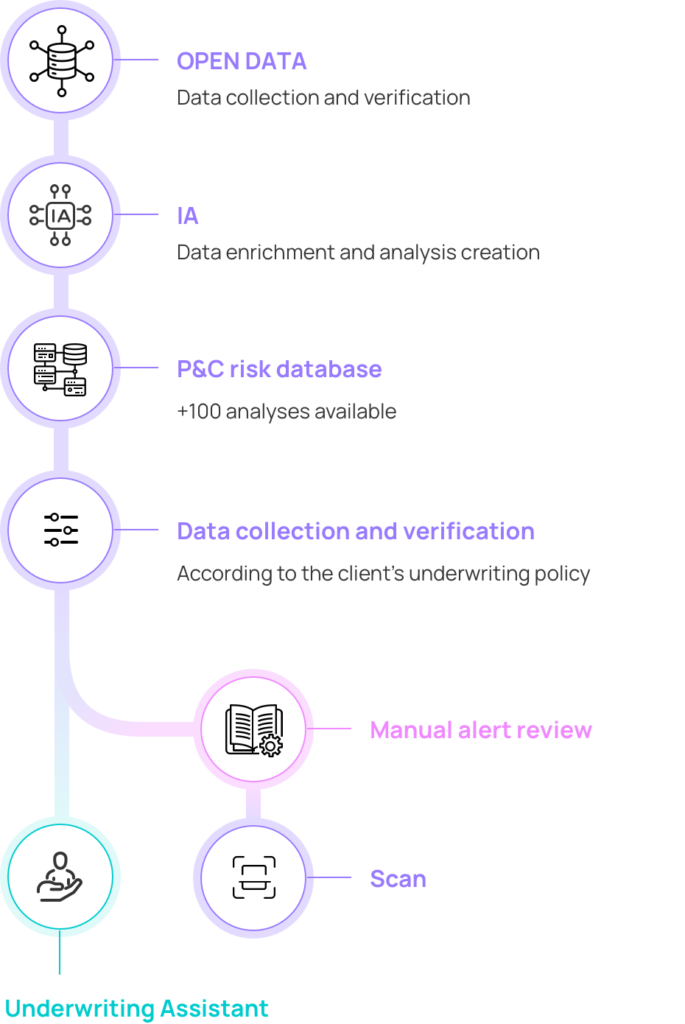

Integrates two functional modules (SCAN / Assistant) optimizing the underwriting process.

Covers five insurance products (MRP, RC, PNO, MRI, RCD), showcasing platform versatility.

Innovation and Excellence in P&C Insurance

At Continuity, we aim to set new industry standards with a focus on data security and process efficiency. Our solutions combine robust data protection with optimal performance to meet the sector’s unique challenges.

Data Governance

A robust internal platform ensures data accessibility, quality, and security while staying independent and aligned with insurance specifics.

Quality and Reliability

Internal data processing enhances data accuracy and offers innovative solutions like siretization and geocoding, surpassing current standards.

R&D Innovation

Strong focus on R&D transforms raw data into unique insights, ensuring flexibility and rapid integration of new data sources, keeping Continuity at the tech forefront.

Insurer Perspective

Tailored data for professional and business P&C insurance needs, providing a turnkey platform that enhances decision-making, reduces analysis time, and boosts efficiency.

Schedule a demo

Discover how we turn complex data into precise insights for optimized underwriting and risk management.

AI VISION & STRATEGY

3 questions to Antoine Sinton, Co-Founder and CSO @ Continuity

What AI development strategy does Continuity follow?

Instead of “large but shallow” models, Continuity adopts a “small and deep” strategy. We develop specialized models for professional insurance, ensuring high precision, easy maintenance, and seamless production integration, while being cost-effective and adaptable globally.

What’s Continuity’s vision for innovation?

We pursue proactive innovation, exploring disruptive, independent solutions tailored to insurers’ needs. This includes automated underwriting recommendations and comprehensive building analysis, enhancing the advisory role of insurance experts.

What makes Continuity’s AI unique?

Accuracy is at the core of our approach. We deliver analyses and recommendations based on reliable, verified data, ensuring insurers’ decisions are informed and precise. This not only builds client trust but also enhances overall insurance service quality for businesses.