USE CASES

AI-powered underwriters for improved coverage and speed

Our interfaces, specially designed for underwriting, help achieve the strategic objectives of growth, profitability and customer satisfaction in commercial P&C insurance.

Contribute to growth while improving risk quality

A key stake for P&C commercial lines

Our solutions meet two key challenges:

- Ensure better follow-up of existing customers throughout their policy lifecycle

- Accelerate the underwriting process while building customer loyalty

We have built the most comprehensive database of companies and buildings. The platform offers a centralized, enriched and dynamic view of companies according to all four major risk criteria: activity, location, building and finance.

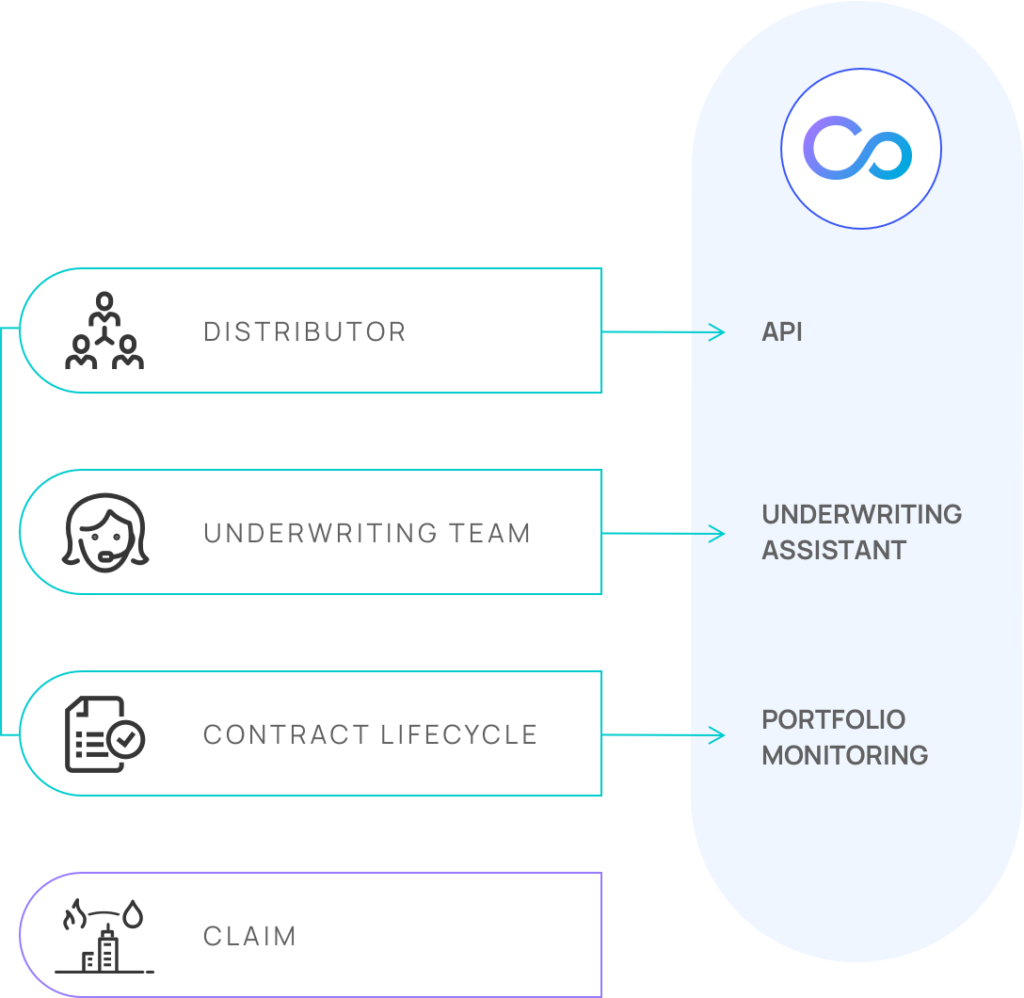

Underwriting Assistant

Faster underwriting for P&C commercial lines

We offer an underwriting cockpit that provides a 360° view of risks when considering new policies or renewals.

Continuity’s underwriting assistant, already adopted by several market leaders, enhances the efficiency of underwriters, reducing file analysis time from 25 minutes to 4 minutes. This improvement is achieved by consolidating the underwriting process, replacing the need for more than fifteen applications with just one: ours.

Activity

Building

Address

Finance

Administration

Context

Background

Risk visit

Preventive measures

Claim history

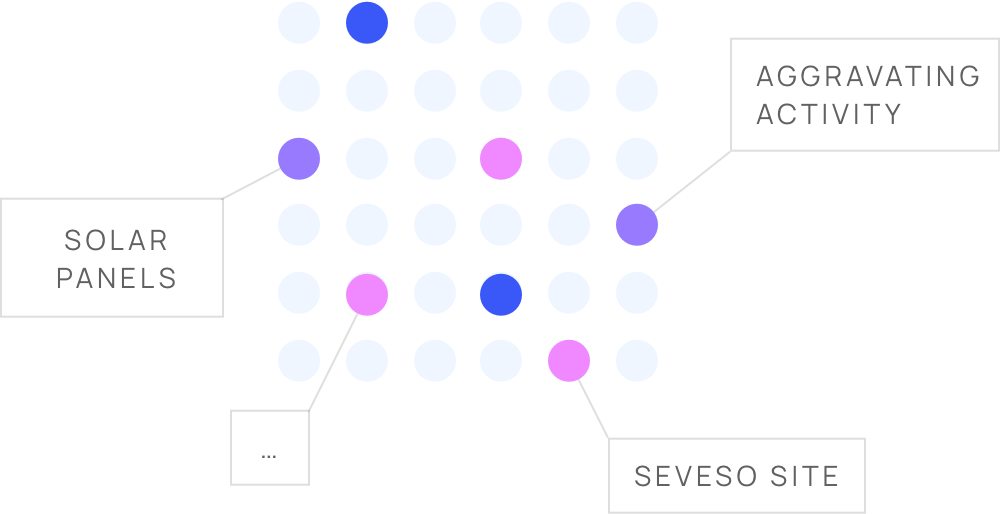

Portfolio scanning

Predictive portfolio monitoring to optimize risk revisits

Once a customer’s portfolio is in place, Continuity enables continuous scanning to detect changes in risk, changes in activity, growth in sales, or, for example, a building that has just been declared “at risk”.

This leads to improved monitoring of all customers throughout their lifecycle, resulting in heightened customer satisfaction and increased efficiency for managers during the claims process.

Book a demo

Estimate your ROI ! Let’s chat

Transformation Partner

More than just technology, we are your transformation partner. We assist Pro/Enterprise insurers at every stage of the underwriting process, spanning risk analysis to underwriting delegation. Our commitment ensures swift proficiency development of your teams regarding underwriting policies, leading to increased employee satisfaction.

Data Centric AI (P&C Risk)

Leverage our expertise in open data and AI to build the world’s largest P&C risk database.

Business Interfaces

Concrete business use cases for efficient data exploitation and underwriting assistance.

Transformation support

Dual technical and business support, guiding your teams throughout the project.

Key advantages and benefits of our solutions

From underwriting quality to case compliance, maximize your underwriting potential with Continuity

Advantages

- The most comprehensive P&C risk database

Over 70 dedicated P&C analyses, 35 configurable risk alerts, 40 sources… - One interface

All the information required for risk analysis of a new case. - No IT implementation

Tool available in an application via a web link. - Ergonomic design

Intuitive design makes it easy and instantaneous to use.

Benefits

- More reliable analysis of new business

Better visibility of incoming business, particularly for secondary sites. - Harmonization of underwriting practices

Faster training of new employees. - Employee satisfaction

Time saved on underwriting tasks with less added value. - Productivity, responsiveness and greater delegation

Increased employee productivity, faster customer feedback. More delegation on the insurer’s side.

What our partners say about us

News & insights

Partnerships, Innovation, and Technology.