DATA-CENTRIC AI

AI for Property and Casualty Insurance

In a world overloaded with data, the real value lies in making sense of it. Continuity helps Pro & Business insurers stay ahead of risk by using specialized AI to monitor portfolio quality in real time. With our portfolio SCAN, we transform external and internal data into actionable insights, flagging hidden threats and helping insurers act before losses occur.

15+

Specialized models

57M

buildings analyzed

3

client-facing AI agents

100

impactful analyses

Insurance Centric AI

Specialized AI for Portfolio Risk Detection

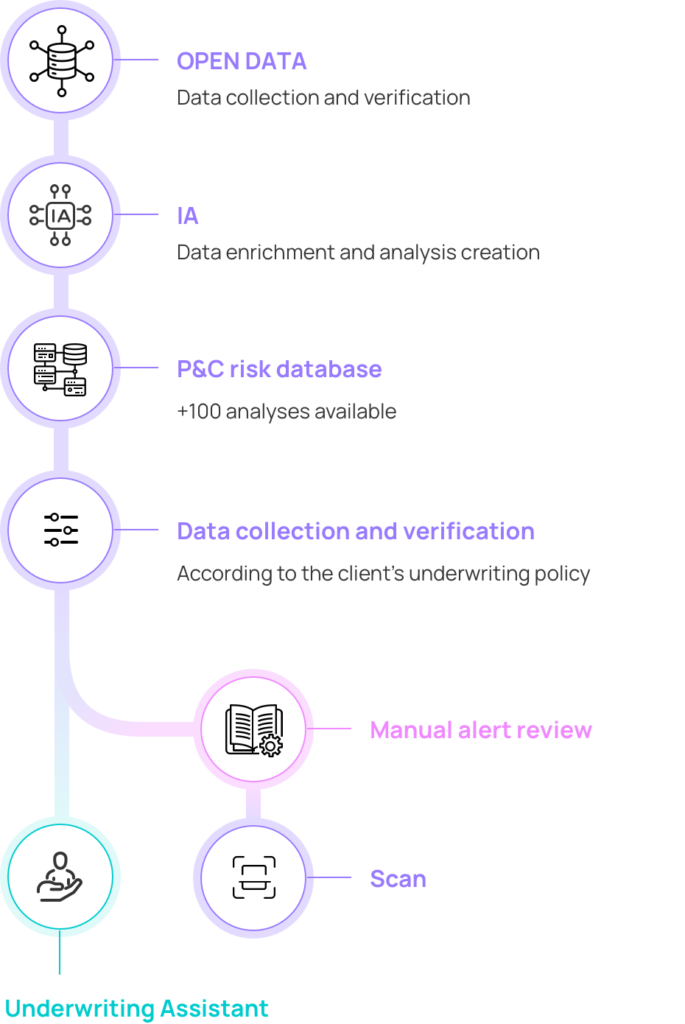

Continuity develops specialized AI for risk analysis in underwriting, offering software tailored for P&C insurance companies.

Our technology infrastructure focuses on data transformation, exploitation, and enhancement. We harness AI and data (external, proprietary, and purchased) to convert complex information into actionable insights.

With robust governance, uncompromising data quality, and the largest R&D team dedicated to Pro/TPE/SME P&C risks, Continuity delivers a unique technological edge.

Our platform reveals what’s really happening inside your contracts. We combine a proprietary database, 15 AI models in production, and rapid case analysis capabilities, complemented by three client-facing AI agents that interact directly with underwriters and risk experts. These agents streamline daily decision-making, accelerate analysis, and enhance collaboration across teams.

By leveraging advanced architectures such as Transformers, Continuity provides high-quality, data-rich models that deliver precise, actionable insights for professional and business insurers.

Technological Leadership

Proprietary AI Models

Proprietary AI models enhance reliability and strengthen data assets.

Our AI models are purpose-built for P&C insurance and optimized for real-world production. With more than 15 proprietary machine learning models in operation, our algorithms are trained on tens of thousands of annotated insurance-specific examples and over 50 million data points. From activity labeling to building-type classification, each model is calibrated to deliver reliable, actionable outputs for portfolio monitoring.

Scalable Data Platform

External Data Collection from Various Sources

Continuity has built a powerful, scalable data platform tailored specifically for the insurance industry. It consolidates more than 300 million rows of structured and unstructured data from over 60 sources. For each company, the platform generates over 300 enriched attributes, allowing insurers to explore risk in unprecedented depth.

Underwriting-Focused SaaS

SaaS Platform Designed for Insurers

Everything we build is designed for fast and practical use by insurance teams. Our SaaS platform provides immediate access to insights, no integration required. With the Portfolio SCAN , users can monitor entire portfolios, identify hidden aggravated risks, and act within weeks, not months. The platform supports all commercial insurance products and aligns seamlessly with underwriting logic, making it both versatile and insurer-ready.

Innovation and Excellence in P&C Insurance

At Continuity, we aim to set new industry standards with a focus on data security and process efficiency. Our solutions combine robust data protection with optimal performance to meet the sector’s unique challenges.

Data Governance

A robust internal platform ensures data accessibility, quality, and security while staying independent and aligned with insurance specifics.

Quality and Reliability

Internal data processing enhances data accuracy and offers innovative solutions like enterprise ID validation and geocoding, surpassing current standards.

R&D Innovation

Strong focus on R&D transforms raw data into unique insights, ensuring flexibility and rapid integration of new data sources, keeping Continuity at the tech forefront.

Insurer Perspective

Tailored data for professional and business P&C insurance needs, providing a turnkey platform that enhances decision-making, reduces analysis time, and boosts efficiency.

Schedule a demo

Discover how we turn complex data into precise insights for optimized underwriting and risk management.

AI VISION & STRATEGY

3 questions to Antoine Sinton, Co-Founder and CSO @ Continuity

What AI development strategy does Continuity follow?

Instead of “large but shallow” models, Continuity adopts a “small and deep” strategy. We develop specialized models for professional insurance, ensuring high precision, easy maintenance, and seamless production integration, while being cost-effective and adaptable globally.

What’s Continuity’s vision for innovation?

We pursue proactive innovation, exploring disruptive, independent solutions tailored to insurers’ needs. This includes automated underwriting recommendations and comprehensive building analysis, enhancing the advisory role of insurance experts.

What makes Continuity’s AI unique?

Accuracy is at the core of our approach. We deliver analyses and recommendations based on reliable, verified data, ensuring insurers’ decisions are informed and precise. This not only builds client trust but also enhances overall insurance service quality for businesses.