PORTFOLIO SCAN

The SaaS platform for P&C insurers to reveal hidden risks

The only AI-powered platform that scans your entire portfolio to uncover hidden aggravated risks and drive targeted remediation – before losses and costly claims occur.

P&C Portfolio Scan

Reveal Hidden Risks. Protect Profitability

Risks don’t stand still. Even policies perfectly underwritten years ago may now contain material misqualifications, directly challenging your objective to improve the combined ratio and accelerate growth.

Even one or two misclassified risks (e.g. undeclared solar panels, excluded activities, or new hazard decrees) can cause millions in losses and add up to 2 points to your combined ratio. These critical risks are hard to detect with fragmented and reactive update processes.

What insurers need now is a smarter, automated, and proactive way to stay ahead.

Book a demo

Estimate your ROI ! Let’s chat

Get a complete view of your portfolio to proactively identify risks and take guided actions

Forget manual reviews or random audits. With SCAN, you can detect silent but critical risks hiding in your portfolio, without disrupting your workflow. Our process is simple, fast, and delivers immediate business impact.

Portfolio Analysis at Scale

Analyze your entire portfolio without depending on clients and brokers, replacing manual data gathering with an automated SaaS platform.

Aggravated Risk Detection

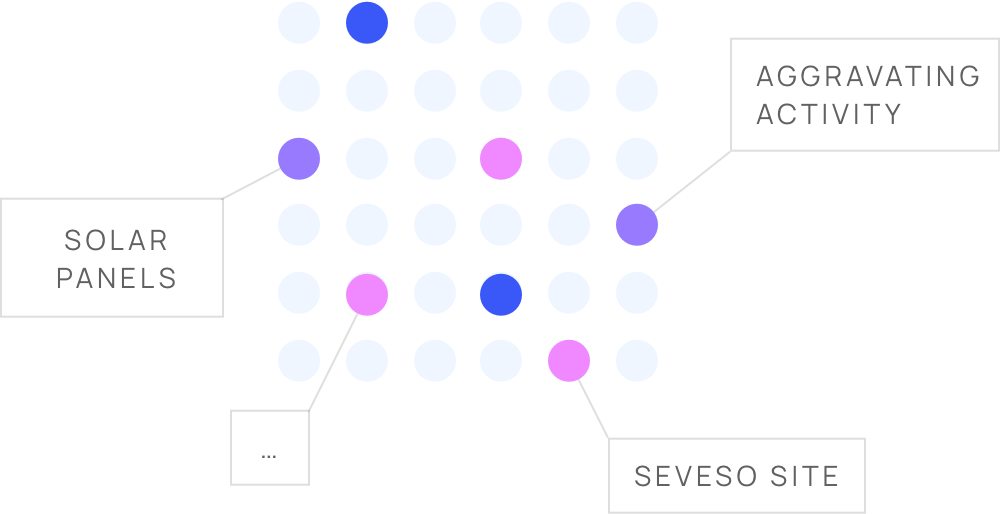

Our AI engine accurately cross-checks policy data with all external sources available to automatically identify hidden aggravated risks.

Intelligent Prioritization & Decision Support

Get a prioritized list of riskiest policies and take guided actions through a user-friendly interface, freeing your team from the burden of sifting through irrelevant data.

Key advantages and benefits of our SCAN solution

From underwriting quality to case compliance, maximize your underwriting potential with Continuity

Advantages

- Comprehensive coverage of the most important key risk factors

Covers activity, building, finance and environment dimensions, with regular additions. - Precise detection of aggravating or sensitive risks

Spots activity shifts, solar panel installations, and revenue increase. - Contract-level insights tailored to underwriting rules

Each policy is evaluated according to your own guidelines. - Continuously enriched and updated risk database

Cross-checks thousands of sources for dynamic portfolio visibility.

Benefits

- Greater visibility into your portfolio quality

Uncover outdated, misclassified, or under-declared contracts. - Early identification of high-risk situations

Act before claims hit by spotting silent aggravating factors. - Improved underwriting profitability

Align premiums with actual risk and reduce loss ratios. - Enhanced customer knowledge and loyalty

Better data leads to more relevant coverage and advice. - Faster, more focused risk reviews

Target only the few contracts that distort your profitability.

What our partners say about us

News & insights

Partnerships, Innovation, and Technology.