Cleanse your P&C commercial lines portfolio of bad risks using AI

Continuity empowers commercial insurers to secure their existing portfolios by revealing hidden aggravated risks that may trigger massive claims.

700

users

6000

distributors

1 million

policies analyzed

5 billion

in premiums managed

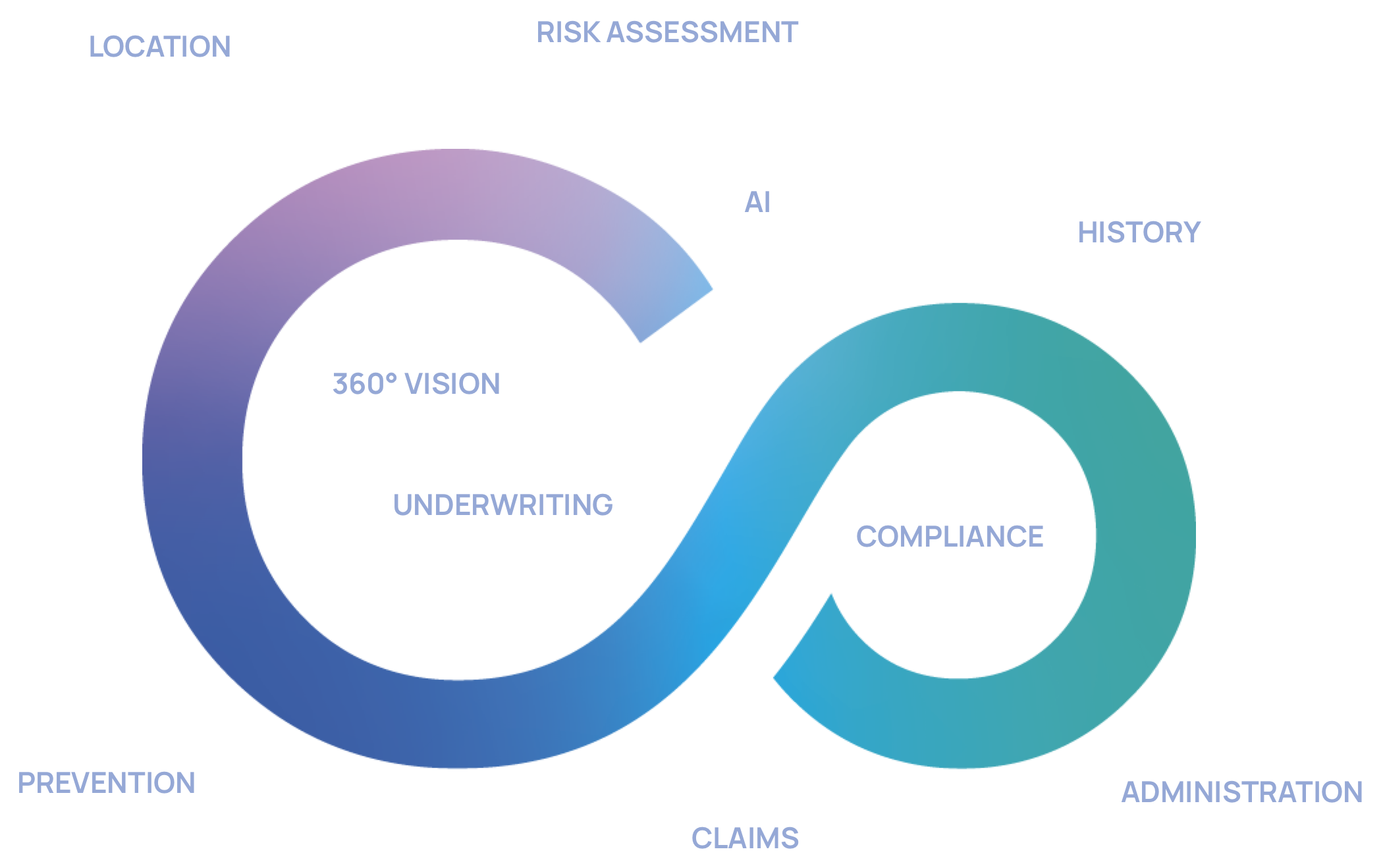

Smarter portfolio monitoring

Proactive detection of misqualified or outdated risks

Continuity transforms the way insurers manage their existing P&C commercial lines portfolios.

Our AI-powered solution tackles a critical blind spot:

- Detecting hidden, misqualified, or outdated risks that can generate massive claims

- Providing a clear, actionable view to review and clean portfolios before losses occur

The SCAN module seamlessly checks for anomalies across thousands of policies, no IT integration required.

In just a few clicks, underwriters can identify contracts needing attention and take action: cancel, reprice, or adapt prevention.

Proven results, tangible impact

Continuity improves efficiency, control, and profitability.

Visibility

Gain clear insight into your portfolio and detect high-impact anomalies.

Compliance

Ensure portfolio consistency with underwriting guidelines.

Control

Address only the few risky contracts that distort your ratios.

Profitability

Stop losses before they happen by acting on a prioritized list of threats.

Why choose Continuity ?

A 100% dedicated technology partner for the professional and business Property and Casualty (P&C) insurance market.

Largest Tech

Team in the market

A team of experts in Data, AI, and P&C

Since 2019, Continuity became an established technological leader. With €15 million in funding and a diverse team, we unite tech, AI, and insurance expertise to cater to your growth and service quality needs.

What Our Partners Say About Us

They trust us

Collaboration, Innovation, Co-construction:

Together, we are redefining the insurance of tomorrow.